In recent years, the concept of embedded wealth has emerged as a major trend in the financial technology (FinTech) sector. Embedded wealth refers to the integration of wealth management services directly into other financial and non-financial platforms, offering seamless access to investment and financial planning tools for consumers.

This allows organizations to offer wealth management services as part of their broader offerings, creating new opportunities for businesses and consumers alike. In this blog, we will explore the concept of embedded wealth, the benefits it offers, and how modern wealth management platforms are facilitating its adoption.

Understanding Embedded Wealth

Embedded wealth is about integrating wealth management services into existing products and services, allowing users to access investment options and other financial services directly through platforms they already use. Instead of requiring individuals to open a separate brokerage account, embedded wealth makes these services available through applications they may already use such as mobile banking apps, benefits providers, insurance companies, and more.

The goal of embedded wealth is to provide a more convenient and efficient way for users to manage their wealth by meeting them where they are already engaged. This approach can democratize access to wealth management, making it easier for people to invest and manage their finances.

The Benefits of Embedded Wealth

The integration of wealth management services into other platforms offers several benefits:

1. Convenience: Users can access wealth management services from platforms they already use regularly. This convenience encourages more people to take advantage of investment opportunities.

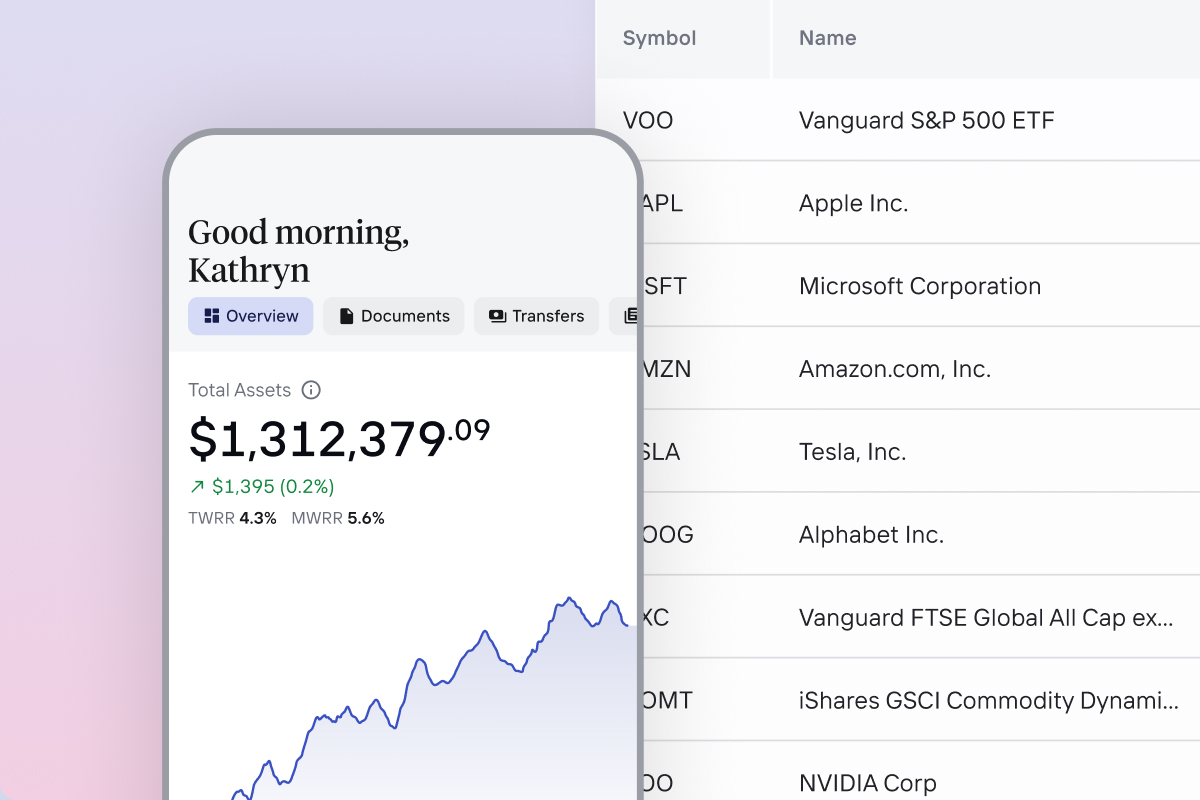

2. Personalization: Embedded wealth can provide tailored financial solutions based on a user's preferences, spending habits, and risk tolerance, leading to more effective and customized investment strategies.

3. Efficiency: By consolidating wealth management with other financial activities, such as banking or payments, users can streamline their financial life and access a comprehensive view of their assets in one place.

4. Accessibility: By embedding wealth management into widely used platforms, organizations can democratize access to investment opportunities, empowering individuals who may not have previously considered investing.

5. Innovation: Embedded wealth encourages innovation by pushing companies to find new ways to offer integrated financial services, leading to more advanced and user-friendly financial tools.

How Modern Wealth Management Platforms Are Enabling Embedded Wealth

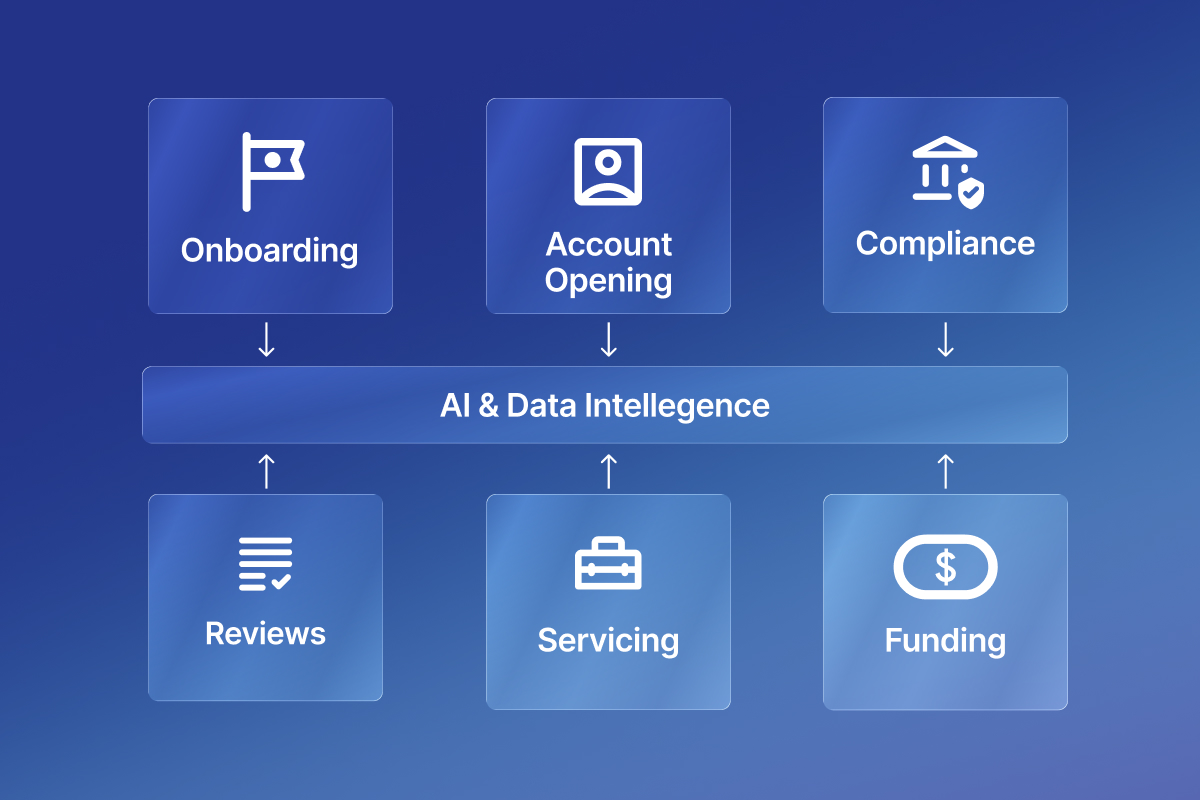

Modern wealth management platforms play a pivotal role in making embedded wealth a reality. These platforms are designed to support seamless integration with other applications, providing organizations with the tools and infrastructure needed to offer embedded wealth services. Here are a few ways these platforms are enabling embedded wealth:

1. API-driven integration: Modern wealth management platforms often provide robust APIs (application programming interfaces) that allow seamless integration with other platforms. APIs enable organizations to embed wealth management tools directly into their existing applications, providing a smooth user experience.

2. White-label solutions: White-label wealth management platforms offer businesses the ability to brand and customize the platform to match their existing offerings. This approach allows organizations to provide investment services under their own brand, building trust and familiarity with their users.

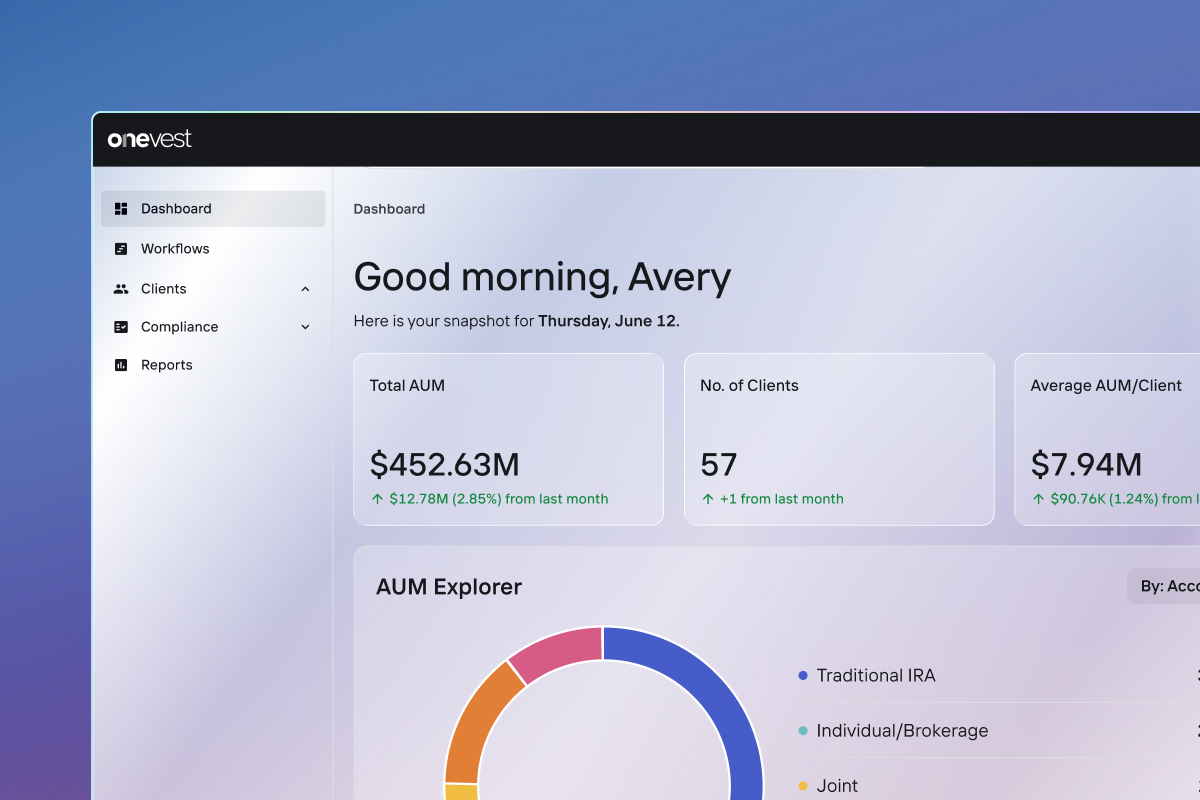

3. Real-time data and analytics: Wealth management platforms can offer real-time data and analytics, allowing organizations to provide personalized and up-to-date investment insights to their users. This level of detail enhances the user experience and helps individuals make informed financial decisions.

4. Regulatory Compliance: Compliance with financial regulations is crucial for wealth management services. Modern platforms often include built-in compliance features, such as risk assessment and reporting tools, that help organizations adhere to regulations and protect their users.

5. Scalability: Wealth management platforms are designed to scale with the needs of their users. This scalability ensures that organizations can handle growing demands for wealth management services without compromising on quality.

Embedded wealth represents a significant shift in the way wealth management services are offered and accessed. By integrating investment tools and financial planning into everyday platforms, organizations can provide a seamless and accessible experience for users. Modern wealth management platforms play a crucial role in this evolution, offering the technology and infrastructure needed to enable embedded wealth services.

As embedded wealth continues to gain momentum, we can expect to see even more innovation in the fintech sector, leading to greater accessibility and convenience for individuals seeking to manage and grow their wealth. Organizations that embrace embedded wealth can position themselves at the forefront of this transformative trend, delivering value and fostering financial empowerment for their users.